Introduction

According to Google, multicultural consumers expect technology and brands to be more personalized, relatable, and inclusive based on their cultural distinctions of language, identity, and passions. Independent studies have shown that this audience is more likely to engage with advertising that takes their unique interests into account and has continued to be a very lucrative, untapped audience.

While the backbone of Hispanic digital marketing is similar to English, it’s imperative to differentiate the two and to leverage all unique opportunities with this specific audience. Your digital strategy should include a separate Hispanic plan that considers Spanish search browsers, search behavior, preferred language, landing pages, and creative content and messaging.

What to Know

* Source: US Census; eMarketer, US Buying Power, by Race/Ethnicity 2000-2018.

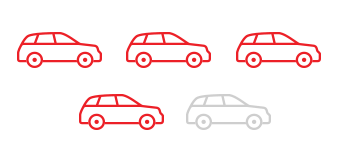

4

years, on average, between purchases

12

additional years of new auto purchasing potential when compared to general market

12%

of in-market Hispanics are first-time new vehicle buyers

3

Potential for an average of 3 more lifetime vehicle purchases than general market consumers

Defying SUVs

Four out of the top five vehicles purchased by Hispanics are sedans (Civic, RAV4, Corolla, Camry, Accord).

Digital First, Dealer Second

The Hispanic auto shopper is 6 percentage points more likely to use digital resources than the average shopper (88% v. 82%); 90% of Hispanic shoppers report doing all their research before communicating with a dealer (v. 86% for average).

Online Video Informs

Hispanics are 10 percentage points more likely to use OLV (Online Video) than the average auto shopper (38% vs. 28%) and 7 percentage points more likely to use YouTube (31% v. 24%); they are more likely to say that OLV (Online Video) helps them:

Compare features of different vehicles (55% v. 44%)

Consider a vehicle they weren’t previously considering (48% v. 43%)

YouTube #1 Video Destination

YouTube still has the highest audience reach among all ad-supported Spanish language Video solutions.

Why Hispanic Digital

624M

annual Spanish language automotive searches

11%

YOY Growth

89%

mobile

44%

queries not matched with Search ads

93% of Hispanic Americans

own smartphones (109 index v. general market).

Hispanic smartphone users spend 25% more time

using them to access the internet than general market.

Hispanics are 23% more likely

to use a mobile device while shopping at a dealership.

They’re looking up vehicle reviews and rankings, comparison shopping, and searching inventory.

Source: Nielsen Total Audience Report Q416; Jumpstart Automotive and Ipsos, Today’s Auto Shoppers, June 2016

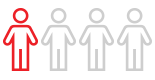

25% of all U.S. millennials

are Hispanic and nearly one-quarter of all 13- to 17-year-olds are Hispanic. They are the fastest-growing teen demographic.

70% of Digital Hispanic millennial purchasers

who search at least monthly have used Spanish to look for information using a search engine.

45% of Digital Hispanic millennial purchasers

agree brand opinion is positively impacted when a website contains elements of Hispanic culture.

85% of Hispanics

are not certain of brand choice when they first begin looking for information online. Hispanics watch 26% less television but 10% more online videos than the general population.

YouTube is the #1

video site used by Hispanics.

What are they watching?

Top 5 categories of online video content where Hispanics over-index

Spanish language Search continues to grow

Source: Google Consumer Surveys among 500 Hispanics via Spanish Android; Q. ¿Con qué frecuencia busca en linea en Español?.

Spanish language CPCs are lower on average

Our Strategy

When it comes to Hispanic Search strategies, there are a considerable number of elements to consider when building the campaign beyond simply translations. For example, Hispanic search behaviors differ from what you typically see and would build your campaigns around with English audiences. Hispanics search in shorter but broader terms and focus on the product and its modifiers, such as “new,” “best,” “discount,” etc.

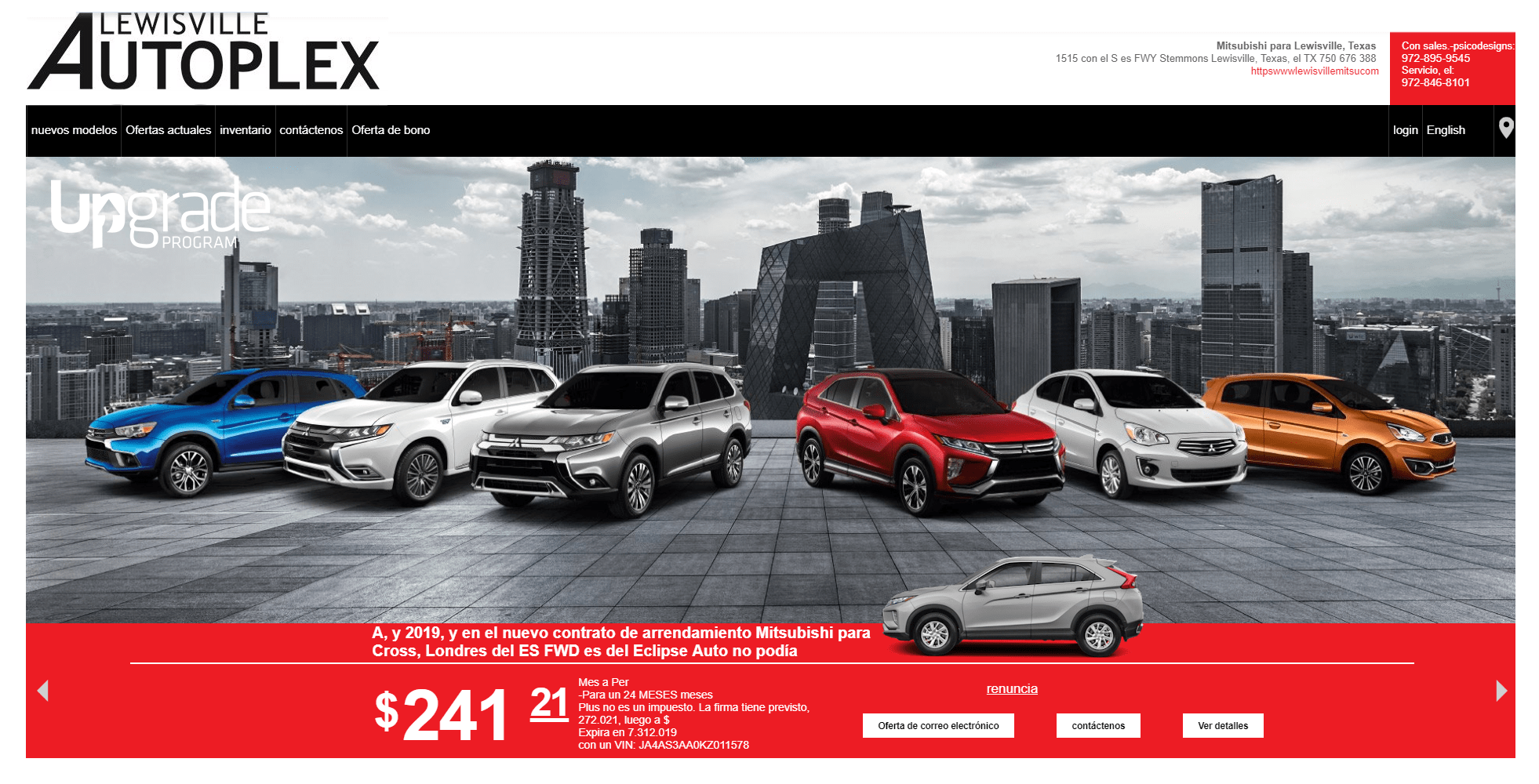

Your marketing efforts should consider the consumer’s preferred language and align with their shopping behavior. The customer journey should be consistent and continue in their preferred language, from search > ad > landing page.

Search

Match keywords to Hispanic search behavior

Common terms and phrases may not translate directly

Use broad, short keywords set to “Broad Match”

“Mejor seguro” rather than “mejor seguro en los estados unidos en 2016”

Include negative terms and common misspellings

E.g. adult content, profanity, “benta de casas” (for “venta de casas)”

Browser Behaviors

- Spanish browser – Spanish keyword (77% of volume)

- Spanish browser – English keyword (21% of volume)

- English browser – Spanish keyword (2% of volume)

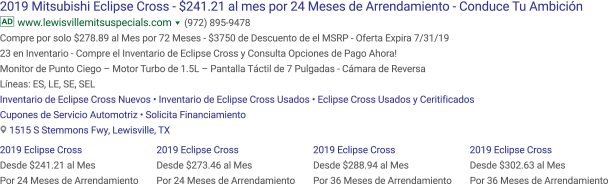

Hispanic Search Ad

Hispanic Landing Page

Video

Target and reach audiences based on language and further define by their behavior.

Language Targeting

YouTube

Based on language preference in user browser settings

AdX

Based on language of the webpage the user is visiting

Other Exchanges

Based on language preference in user browser settings

Audience Targeting

Affinity Audience

Users who have demonstrated a qualified interest in a given topic or passion point.

Custom Affinity Audience

Custom-made audiences based on interests and frequently visited websites. For YouTube Moments, Custom Affinity Audiences provide defined and targeted custom-made audiences that enable brands to obtain substantive reach across niche groups of users, such as Latin Grammys and Soccer.

In-Market Audiences

Consumers who are actively in the market for products and services.

Remarketing

Life Events (getting married, moving) and Consumer Patterns (frequent big box shoppers) introduced, also powered by Search signals.

Life Events and Consumer Patterns

Reach out to visitors who already visited your site, engaged with previous Display/Video campaigns, and/or completed views of your YouTube videos.

Similar Audiences

Consumers who have the same behavioral profile as those who are on your remarketing lists.

Creative Considerations

- Connect with Hispanic consumers through culture, passions, and identity.

- Carefully consider voice talent and imagery when developing assets. There are many cultural differences to consider depending on the specific market.

- Tap into Hispanic culture by tying marketing efforts around their passion points, such as food, Latina celebrities, local influencers, bilingual content, and local partnerships.