New Dealership Launch Checklist & Priorities

Market Research

☐ Define primary marketing area based on Mitsubishi-defined AOR (area of responsibility)

☐ Align all marketing efforts with primary marketing area, focusing on mediums with capability to have greatest concentration in area

☐ Understand your audience and their motivators, and set messages accordingly

☐ Identify audiences/brands most likely to trade in to Mitsubishi

Audience Hierarchy

- Current Mitsubishi owners (target by YMM)

- Mitsubishi-provided hand-raisers

- Off-brand model segments most likely to switch to Mitsubishi

- In-Market audiences (same brand, conquest model segments)

Marketing Mediums

- Targeted Mail (sales & service combo)

- Digital (Search, Pre-Roll Video, Facebook, & Display)

- 3rd-Party Providers (pre-owned)

- Traditional Media

Creating a Grand Opening Event

☐ Create grand opening campaign/sales event to launch around the opening of the dealership (campaign can be run for at least two months)

☐ Host true grand opening weekend event or private pre-grand opening weekend/ceremony

☐ Partner with media outlets to host onsite remotes, giveaways, and promotions

☐ Earned Media: Create public relations and outreach plan. Contact your local news outlets and invite them to grand opening event or private pre-opening event

☐ Incorporate Service in Grand Opening Promotion: Service drives sales – “shorter putt.” Identify all same-brand vehicles in operation in your defined market/AOR (area of responsibility) and target with combo sales/service lost leader pricing (i.e. introductory $9.95 oil change)

☐ Partner w/ charity and local organizations to make launch more newsworthy and allow you to tap into their databases to cross-promote

☐ Invite local influencers to grand opening event or private pre-grand opening event

☐ Market with invitation/campaign creative to current Mitsubishi owners in AOR (area of responsibility)

Building Your Brand: Marketing Strategies & Priorities

Marketing Strategy

Building a comprehensive marketing plan requires the consideration of data, research, historical information, market variables, and much more. Below is a high-level overview of different strategic approaches and benchmarks to consider as a baseline.

Setting Your Marketing Mix & Budget Allocation (varies by brand & market)

☐ Targeted: _____% (35% recommended)

☐ Digital: _____% (35% recommended)

☐ Traditional: _____% (20% recommended)

☐ Third-Party: _____% (10% recommended)

☐ AD PVR Target: ________ ($600 – $700 recommended, varies by brand & market)

Outbound Marketing Hierarchy (Sales)

☐ Current Customers (2+ years ownership): Customers who purchased from you, who own your brand, and who actively service are statistically the most likely to purchase from you

☐ Same-Brand Conquest

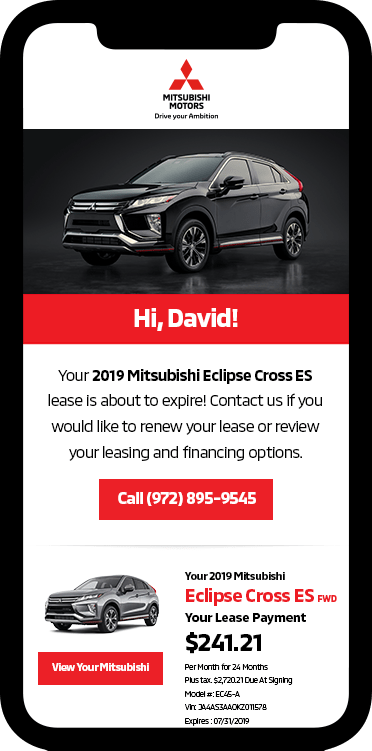

☐ Expiring Lease (filtered by current payment, vehicle type)

☐ Off-Brand Conquest: First prioritize by specific make and model segments that align with historical trade patterns and/or OEM programs

Marketing Campaigns & Programs

☐ Brand Differentiator Programs: “Why Buy Here” campaign (i.e. Oil Changes for Life, 3-Day Exchange, etc.)

☐ Monthly Sales Events: “Why Buy Now” campaign (Holiday Events, 72-Hour Sale, Red Tag Event)

☐ Sales in Service Lane Programs: Upgrade Program, Vehicle Exchange Program

☐ Employee Pricing Program: Offer employees, families, and employees of local businesses the opportunity to buy at a pre-defined, below-market rate

☐ Philanthropic Programs: Develop partnerships with local charities, schools, and organizations

Database Strategy (Owner Communication & Data Mining)

Leveraging your existing customer database with a 1-to-1 strategy can often be the most efficient and cost-effective way to generate sales. By identifying optimal target audiences within your database who are likely to be in an “upgradable position,” you can create a valuable customer touchpoint and present a compelling value proposition to upgrade their vehicle.

Finance Portfolio

☐ Expiring Loans: Customers who have an expiring finance loan in the next 12 months and have a minimum equity of <-$2500> in their vehicle

☐ High Interest/APR: Customers who are currently carrying a high-interest loan and could be candidates to lower their current payment by refinancing or getting a new vehicle

Lease Portfolio

☐ Expiring Leases: Customers who have an expiring lease in the next <9 months> and have a minimum equity of <$0> in their vehicle

☐ Lease Mileage: Customers who are over halfway through their allowed lease mileage & within <9 months> of their expiration date who are estimated to be driving more than their allowed miles

Service/Selling in the Service Lane

☐ Upcoming Service Appointments: Customers who have scheduled service visits and have potential equity

☐ Service Reimbursement – High Customer Pay ROs: Customers with closed ROs with high cost

☐ Warranty Expiration: Customers who did not purchase an extended service contract and are within <5 months> or <1,000 miles> of their OEM service contract expiring

Marketing Tactics

☐ Outbound Email

☐ Outbound Phone Call

☐ Targeted Mail

☐ Facebook Custom Audiences

< > – Recommended general data segments, may vary by brand, store or market.

Creative & Messaging Examples

Direct Mail

CRM Strategy Unsold Prospects

As consumer shopping and purchasing behaviors evolve, it’s important to make sure you’re evolving alongside them, even before customers set foot in your showroom. Once they’ve submitted a virtual lead and you have their contact information, it’s important to make sure you’re creating a positive first impression and continuing to provide a “wow” experience throughout the process.

Getting Started

☐ Establish automated customer touchpoint cadence & workflow (online), time- & activity-based

☐ Establish personal customer touchpoint cadence & workflow (agent)

☐ Develop creative templates (responsive, relevant, retail, professional)

☐ Define customer categories (active, inactive, incorrect phone #, incorrect email, too soon, etc.)

☐ Schedule CRM onboarding & training

☐ Create inbound & outbound script library for BDC agents

☐ Roleplay training with BDC agents

☐ Define processes: How to handle pricing over the phone (empower BDC or hand off to sales team), number of calls to each customer & voicemail (2x calls, voicemail, call)

☐ Ensure all templates have proper calls to action & dealer info (1-touch steps for calling, texting, & directions)

Monthly Checklists

Management

☐ Mystery shop your dealership (submit online lead)

☐ Mystery shop competitor

☐ Review monthly marketing campaign & call tracks

☐ Set monthly goals with BDC

☐ Hold ongoing training meetings

☐ Deploy monthly promotions (1x per week)

☐ Alert unsold prospects of increased incentives, possible price drops, etc.

☐ Promote used cars or service

Mystery Shop

☐ Response time: How long until your first response and emails/calls thereafter?

☐ Relevancy: Are you getting relevant answers to your questions?

☐ Professionalism: Are your written and verbal responses and templates professional?

☐ Pricing: Are your offers competitive with the competition? Are you offering consistent pricing or pricing at all when requested?

☐ Communication: Are you asking customers upfront their preferred method of communication & responding accordingly?

Website Setup/Review Checklist

☐ Sales specials

☐ Service specials

☐ Text/chat platform

☐ 3-4 rotating banners

☐ Site speed under 5 seconds

☐ Trade-in evaluator tool

☐ Finance application tool

Digital Media Strategy

Traditional Media Strategy

Traditional media can still be an effective brand marketing channel, especially for larger dealer groups that have an extended footprint and bigger budget and can be funded by multiple dealerships. For single-point dealers without group leverage, it’s imperative to make sure you’re being efficient with your spend and not overbuying a market. Broadcast media and radio are typically more expensive and often reach well beyond your sales market, costing you money to communicate to customers who are less likely to do business with you. First look to prioritize your efforts on media channels that are primarily serving your OEM-defined market and whose audience aligns with your local buyer.

Agency Vendors & 3rd Parties

Establishing the right partners for your business is imperative. The marketing and technology space is continually evolving, and you need business partners who are never stagnant in their space of expertise, who are pushing new boundaries, and most importantly, who always have your best interest in mind. Make sure you are holding all parties accountable and continually evaluating their efforts. The 3rd-party lead space has become congested with multiple vendors/providers, causing diminishing returns and often providing duplicate leads that may also be sold to competitors. Make sure you choose the right providers that are continually delivering and meeting pre-defined expectations. Look for VIN-based pre-owned Search solutions that will allow you to feature your inventory online and independently generate leads.

Traditional Media Checklist

☐ Are you buying stations/channels that index with your dealer’s target audience?

☐ Does your media buy align with your brand-defined AOR (area of responsibility), or current sales/service market?

☐ What is your buy’s reach and frequency? (While there are a lot of variables to consider, a 75% reach and over 3X frequency is generally a good baseline)

☐ Who is your target audience when buying media? (While there are a lot of variables to consider, Adults 25-54 is a good baseline)

☐ Is your media buyer reconciling your buys to ensure the plan is running accordingly?

☐ Is your media buyer using qualitative media planning tools when considering buys?

3rd-Party Lead Providers Checklist

☐ Are you continually monitoring and measuring your 3rd-party spend and the percentage of overall budget?

☐ Are you monitoring the lead and sales conversion rates of individual vendors?

☐ Are you running VIN-based used car Search for your pre-owned inventory?

☐ Is your BDC/sales team overwhelmed with spending time on “unconvertable leads?”

Digital Media Provider Checklist

☐ Are your current digital campaigns payment- and VIN-based, marketing your actual vehicles?

☐ Are your campaigns marketing all your models, not just core models?

☐ Do you have the appropriate digital channel mix and strategy?

☐ Is your current provider using a bid management platform for Search?

☐ How are you measuring success for Digital? Does your provider measure and optimize based on “in-store visits?”

☐ Are your Search campaigns integrating text features?

Agency Best Practices & Checklist

☐ Are your agencies providing you with a monthly or quarterly competitive analysis, reviewing online specials, mass market offers, website inventory pricing, lead responses, and more, and providing strategic recommendations accordingly?

☐ Are your agencies “mystery shopping” your dealership and your competitors on a monthly or quarterly basis?

☐ Are your agencies providing you with weekly/monthly/quarterly ROI reports?

☐ Are data and technology at the forefront of their strategies?

☐ Are you reviewing results by marketing medium and/or channel and adjusting accordingly?

☐ Are your agencies developing annual, quarterly, and monthly marketing plans?

☐ Are your agencies making monthly adjustments to your plans, or are they setting and forgetting?

Point-of-Purchase Strategy

It’s important to connect the consumer online experience with the offline experience at the dealership. The best brand retailers deliver a consistent and cohesive message across all mediums and channels of marketing, including the in-store experience.

Campaign Recommendations

☐ Monthly Sales Event

☐ Why Buy/Differentiator (always up)

☐ Sales in the Service Lane (always up)

Primary Material Recommendations

☐ Hanging vinyl banners

☐ Window clings

☐ Misc: Posters, car toppers, collateral